John Leiper – Chief Investment Officer – 11th December 2020

In its latest economic outlook, the OECD increased its expectations for global GDP. For 2020, the improvement is minimal, reflecting an upward revision, in real GDP, from -4.5% to -4.2%. But beyond that, growing economic momentum should boost global growth to pre-pandemic levels, estimated at 4.2% in 2021 and 3.7% in 2022.

That’s clearly good news, but risks remain, and importantly, the recovery will be far from even. China, the world’s second largest economy, has proven particularly resilient to the virus. The country started recovering far earlier than its peers and as such is the only major economy expected to record economic growth in 2020. Going forward, China is expected to account for over one-third of global growth in 2021, estimated at 8%. In contrast, the US and euro area are forecast to contract -3.7% and -7.5% this year, before growing 3.2% and 3.6% in 2021. That is a far smaller contribution relative to their respective weights in the global economy.

Not surprisingly, investors are becoming increasingly bullish about the prospects for EM. The most recent Bank of America global fund manager survey highlighted an ‘unambiguous rotation to EM’ with the ‘largest proportion ever saying EM currencies are undervalued’. Within emerging markets, the current ‘winners’ include China, Taiwan and Korea. Collectively, these countries make up approximately two-thirds of the EM Asia index and as shown in the chart below, in white, this index has outperformed the broader emerging market index by approximately 10% this year.

On mobile: review detail in landscape mode

However, past returns are not indicative of future performance, and what I find particularly interesting about this chart is the clear inverse relationship between EM Asia and EM Ex Asia, in red, which tends to move in cycles and does so with remarkable symmetry over time. If historical correlations hold true, then we could expect EM Ex Asia to rebound and outperform going forward.

This shift in relative fortunes is predicated on the normalisation of economic activity going forward, assuming no issues arise in the ongoing development and deployment of a vaccine. Key drivers also include the continuation of ultra-accommodative monetary policy, easing financial conditions (primarily via US dollar weakness) and further fiscal stimulus support packages.

The MSCI EM Ex Asia index is skewed towards cyclical sectors of the economy such as financials, materials and energy. As such this theme is consistent with our outlook for a continuation of the rotation from growth to value. Regionally, the index is comprised of several countries including Brazil, South Africa, Russia, Saudi Arabia and Mexico, amongst others.

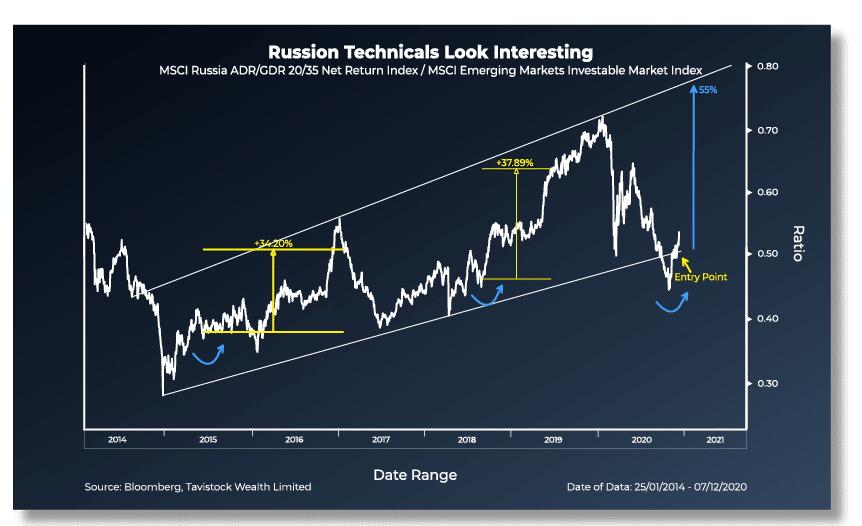

We’ve run a number of simulations and our preferred way to play this theme is via unhedged equity exposure to Russia and Brazil. Using historic ‘bottoms’ in relative valuations, shown by the blue arrows above, we found that Russian equities delivered strong subsequent returns. The last two such occasions saw Russian equities outperform the broader EM equity index by 34% and 38% respectively, capturing the majority of potential gains as defined by its multi-year upward channel. Following a particularly weak 2020, Russian equities are now back above support and we see long-term potential upside of 55%. Key drivers include valuations (Russian stocks are extremely cheap), deteriorating political risk (recent gains imply investor confidence in the region has offset the renewed risk of sanctions following Biden’s recent victory) and a rebound in oil prices (energy has lagged the broader commodity rally thus far but we expect catch-up gains in 2021 which should benefit energy producing countries like Russia).

On mobile: review detail in landscape mode

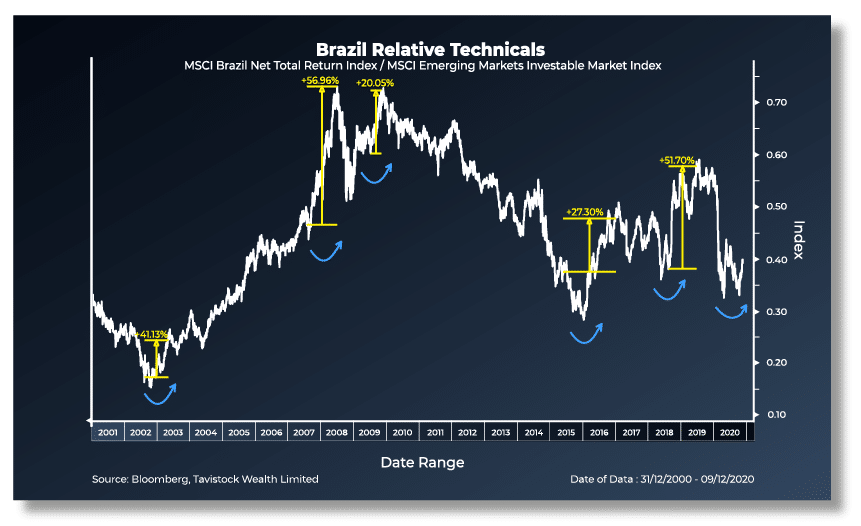

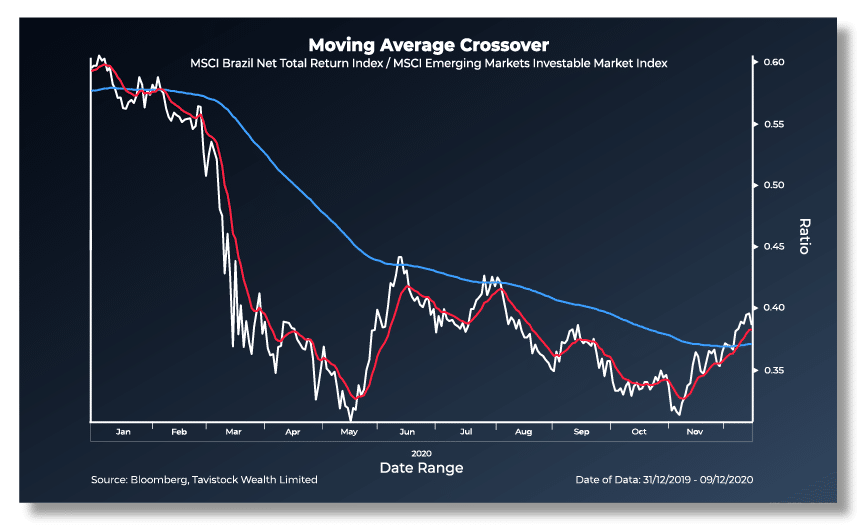

We also like Brazilian equities which tend to perform well against a backdrop of recovering global GDP, low interest rates and a weakening US dollar. As shown in the chart below, the index has delivered average relative outperformance of 40% during the last 5 cycles, once again indicated by the blue arrows.

On mobile: review detail in landscape mode

Brazilian equities have massively underperformed so far this year, suffering large outflows from foreign institutional investors as the region became a pandemic hotspot. Positive vaccine news flow, coinciding with the start of summer across the southern hemisphere should reduce covid related risks going forward whilst resilient demand from China for commodities, such as iron ore, will benefit the materials and energy intensive equity market, via companies like Vale, which makes up 15% of the iShares MSCI Brazil ETF. Brazil also has one of the steepest yield curves around. This is positive for financials, on a relative basis, which represents the largest sector within the ETF.

Despite recent gains the Brazilian real continues to lag EM peers and we see scope for further catch-up gains given forecast structural US dollar weakness. That said, the lacklustre currency also reflects growing concern over Brazil’s fiscal situation, with one of the highest debt to GDP ratios of any emerging market, 6% of which needs to be rolled over by April 2021. One of the key risks for next year is if we see Jair Bolsonaro, president of Brazil, ramp up spending into the 2022 election, without implementing necessary fiscal reforms, hitting investor sentiment in the process. Nonetheless, we believe the broader rotation to EM value should outweigh these concerns. This is the start of a new cycle and Brazilian equities could offer considerable upside potential from here.

On mobile: review detail in landscape mode

From a market timing perspective, the 10-day moving average has just crossed the 120-day indicating a potential buying opportunity.

This investment Blog is published and provided for informational purposes only. The information in the Blog constitutes the author’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular investment strategy is suitable for any specific person. Source of data: Bloomberg, Tavistock Wealth Limited unless otherwise stated.

Want to know more about the Equity Markets?

Please contact us here:

The Great Rotation

In Nothing Is More Powerful Than An Idea Whose Time Has Come, published in November, we introduced the idea of a Great Rotation across US equity markets.

The Unemployment Problem

The Fed’s dual mandate is price stability and maximum employment, but Jerome Powell has been unequivocal that it’s all about the latter.

Reflections

This is the first blog since the holiday break. Whilst travel restrictions meant it wasn’t the holiday that had been planned, we adapted, and enjoyed the opportunity to spend some time together as a family and reflect on the last few months.

Let The Good Times Roll

Markets are ebullient, and they have every reason to be.

Since the Market Low

The ACUMEN Portfolios continued their strong run throughout October, largely outperforming the market composite benchmark and IA sectors (used for peer group comparison purposes) which lost ground across the board.

Canary in the Vol-mine

With the US election just 8 days away, financial markets are following the polls and pricing in a Biden win. The prospect for a Democratic clean sweep has contributed to the rising ‘Blue Wave’ narrative benefiting those companies that stand to benefit from Democratic party policy.

Investment Philosophy

A 2018 study by Dalbar suggests that the traditional route of identifying Fund Managers consistently outperforming in their sector or industry, (“Fund Picking”), seems to have fallen by the wayside.

Pivot To ESG

The recovery in US equity prices, from the corona crisis, has been one of the most rapid in history.

THE CHINESE TECH STRUCTURAL GROWTH STORY

Commodities are nothing if not cyclical. They rise and fall in value with remarkable consistency over time.

The Return of Inflation

Quantitative easing, or QE, is where a central bank creates money to buy bonds. The goal is to keep interest rates low and to stimulate the economy during periods of economic stress.